9 eCommerce Trends that will Shape 2018

9 eCommerce Trends that will Shape 2018

Did you know that eCommerce is growing 23% year-over-year, and is expected to grow to $4 Trillion by 2020.

This year promises to be another bumper of a year for eCommerce. eCommerce trends set the tone for the year ahead by shaping the direction your business, your design and your marketing will go.

Trends such as Messenger ads and video marketing will continue to dominate and change the way we budget for advertising. While trends such as augmented reality and voice assistant purchases, previously were reserved for big eCommerce brands, could become more accessible to small to medium online business driven by the growing millennial and Gen X shopper online shopper.

The bottom line is: the landscape is changing; changing, but increasing at a phenomenal rate and if you want to up your game this year, getting ahead of these trends will mean more money in the bank. Here are the top 10 eCommerce Trends and Predictions that shape 2018:

eCommerce Trend #1: Messenger Ads to Lead Facebook PPC

Facebook Messenger ads were already hitting some awesome ROI numbers in the last quarter of 2017 and this is expected to climb over the next year. There is a huge push by Facebook to enter the ‘email marketing game’ with their Messenger ads and although this in no way means email marketing is dead (duh!), it is going to have a huge impact on the direct marketing market.

With the rise of Messenger ads we will also see an increase in Chatbots. Chatbots are no longer just for the ‘big guys, with Facebook already offering automatic replies and built in chatbots to small businesses to help simplify the buying process without losing that personal touch.

Bonus Tip: 9 Merchant Chatbots on Facebook Messenger to Inspire You

eCommerce Trend #2: Welcome Voice Shopping

The new kid (trend) on the block for 2018 is voice shopping. With the surge in popularity of voice-assist products such as Google Home and Amazon Echo, voice shopping is the new best thing in shopping. In fact it is estimated that 40% of millennials are already using their voice assistants to shop online. From the middle of 2017 we saw big retail giants such as Target solidify their partnership with Google voice-assist home products, offering brands a way to streamline customer experience in a whole new way.

For now this technology and marketing trend is out of many smaller eCommerce sites reach, but with the jump to voice-assist shopping on android and iPhone not that far away, the opportunity for smaller to medium eCommerce brands to cash in on the action is in the cards. For now, this is a trend we will watch closely in 2018!

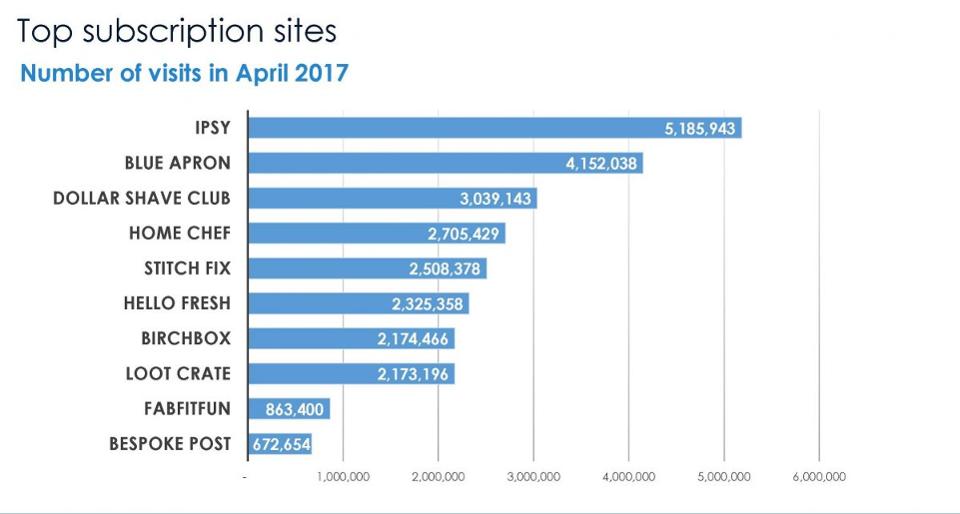

eCommerce Trend #3: Subscription Surges

In 2018 we are expected to see a surge in subscription-based service business models, such as the likes of Forbe’s subscription leaders like Amazon Prime, Loot Crate and Birchbox in smaller online stores. With a definite leaning towards providing more personalized service to create a bigger loyal-customer base in eCommerce, we will see a lot of medium online stores incorporating subscription models into their traditional setups and models.

Still, subscriptions aren’t just about subscription boxes such as tf Loot Crate or providing memberships to fitness programs such as FitGirls, but can be adapted for all sorts of niches. Selling online fashion? Add a seasonal accessory subscription that shoppers can sign up for to get your latest seasonal trends first. Drop-shipping online printed homeware? Why not start a mug-a-month club?

eCommerce Trend #4: More Personalization

I have said it before on this blog: Personalization is so important. However as we go into 2018 it is even more so. This is the year that your marketing needs to be as segmented as possible, where you need to fine-tune your customer service practices like never before and customer experience should be top of your agenda. The bottom line is that customers are getting more and more bombarded by options and in turn online stores will be finding more ways to personalize their shopping experience for customers.

If you can get a jump on that this year, you will be ahead of the pack in time for 2018 final quarter, giving you a big advantage to the big shopping days. Segment your email marketing more so that you are sending products to those shoppers more inclined to buy, optimize your remarketing AdWords campaigns and think small, highly targeted groups, and ensure your site and checkout offers recommended products to customers – all designed to make shopping feel more personal and buying choices easier to make.

eCommerce Trend #5: Increased Product Customization

Personalization is not just about shopping experience this year. 2018 is set to see an increase in product customization and more fulfillment options as well. Big brands such as Puma are already implementing customized options that help those customers ‘stand out of the crowd’ and buy products they feel are just for them.

Image Source

With the rise of platforms such as Inke, which allow shoppers to buy personalized products in niches from clothes to furniture, we will see the 2017 new-climber move into the eCommerce spotlight and allow smaller online stores to cash in on this action.

eCommerce Trend #6: Augmented Reality for Small Business?

We know AR (Augmented Reality) was a huge buzz word for big retail in the second half of 2017, but will it make mainstream eCommerce in 2018?

Not all of us have an IKEA sized budget to product apps like the above, however, in 2018 we will see more eCommerce and retail superpowers moving towards AR and VR. And with it, the need for online stores to come up with more visual ways – such as virtual dressing rooms – to show off their products in the coming years. We don’t expect this to filter down to small eCommerce just yet, but this is something you should definitely be keeping an eye on in 2018.

eCommerce Trend #7: Content Rich Marketing Strategies

If you haven’t invested in a content marketing plan yet, this is your year. Content rich marketing strategies are already being used by most bigger online stores who are said to save $14 on each new customer generated, but in 2018 we will see this filtered down to smaller business who will produce better, more helpful quality content this year.

According to Demand Metric and Hubspot, respectively, interesting content is now one of the main reasons why people follow brands, and marketers who put effort into company blogs are 13 times more likely to generate a positive ROI. This means an increase in things like how-to-videos and Instagram UGC, which will separate those stores who are not seen as helpful authorities in their niche from the rest of the pack and leave them behind.

Bonus Tip: 6 Tips to Create a Scalable Content Marketing Campaign

eCommerce Trend #8: Video Will Still Top Dog

If you haven’t started using video marketing, 2018 has to be your year. In November we saw ‘amature’ Facebook video views reach as high as 8 million views, bringing in huge fourth quarter revenue.

According to Huffington Post‘s eCommerce predictions for 2018, it is estimated that by 2020, video will make up 80% of all online consumer internet traffic and that video marketing increases your CTR by 200-300%.

What does this mean for you? This year, your content strategy should be all about video marketing and small to medium businesses that haven’t already, need to up their video content game in a big way to keep up with their competitors.

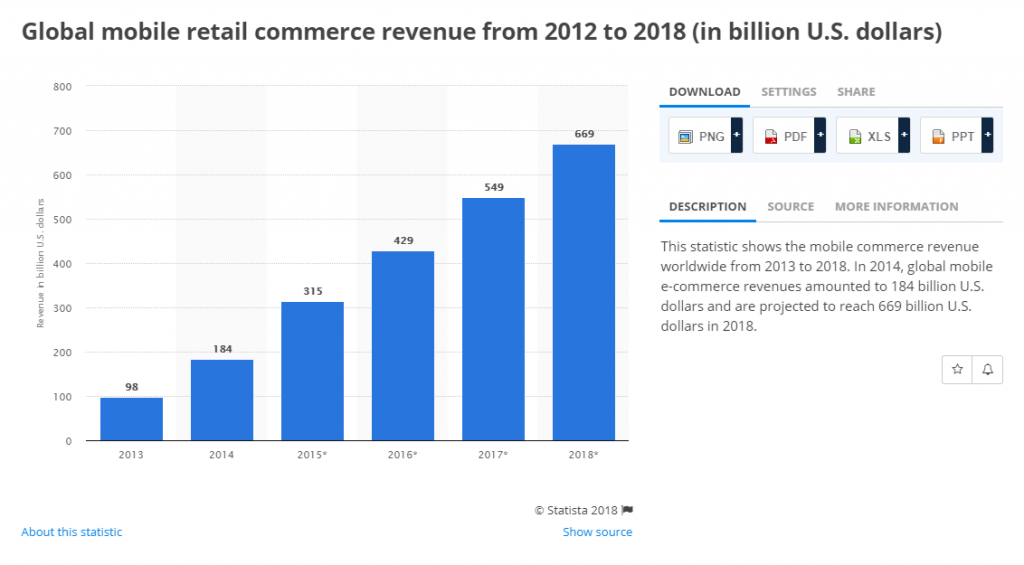

eCommerce Trend #9: More Mobile Shopping

By end of 2018 it is estimated that mobile sales will account for 50% of eCommerce revenue and is set to make up $669 billion worth of sales in 2018, a whopping 20% increase from predictions for 2017. This is the year you want to make sure that you marketing to those mobile shoppers to help you cash in on more sales!

—

There is no doubt about it, with the huge influx of online stores and the global shift from retail to online shopping that continues to climb steadily in the coming year, we’re in for a bumper year. Stay tuned to our blog for up-and-coming 2018 eCommerce trends as we tackle this year with you and guide you through all the tools you need to make this your best sales year ever!